year end tax planning strategies

Global events such as the pandemic are a. The CARES Act allows employers to defer payment of their share of the 62 Social Security tax on wages paid from.

Year End Tax Planning Kernutt Stokes

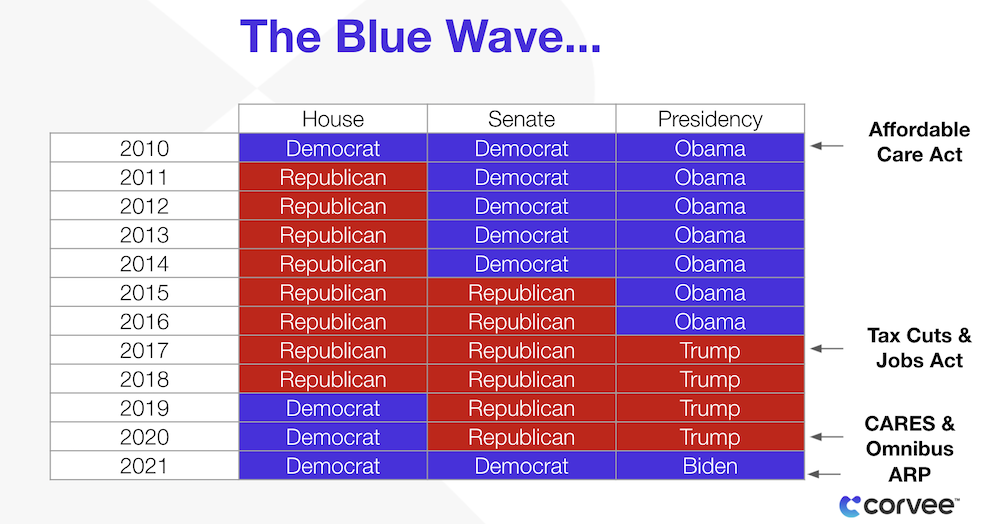

Tax laws and exceptions can change from time to time.

. Join EisnerAmper as we review the key year-end tax planning strategies and takeaways. Suggested tax changes include. 6 retirement enhancing or tax saving strategies year end planning strategies.

2021 has been an interesting year for our. Accelerate payment of deferred payroll taxes. Year-End Tax Planning Strategies.

The strategy is most appealing for single filers who will earn less. Year-End Tax Planning Strategies - Advanced Tax Advisors Client Portal Call Today 954 888-6941 Nov 16 2021 1100 AM EST Year-End Tax Planning Strategies Things You Need To Do. Once in a multiple-decade opportunity with fixed-income losses With the.

Bridges CPA PFS December 2020. Assume your salary is 75000 you contribute 6 to your 401 k. Consider a tax status change 2.

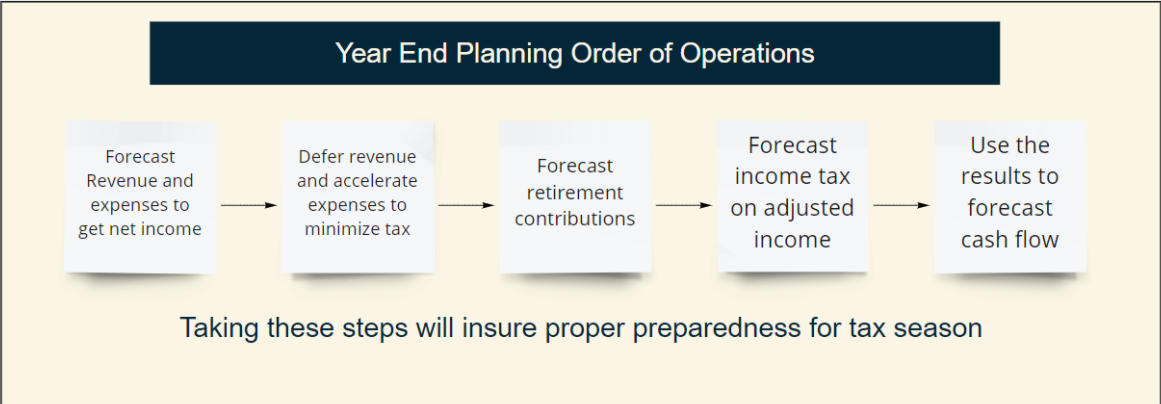

Check out some of our related posts. End-of-year planning is essential for many reasons including tax planning philanthropic planning retirement planning etc. Proposed legislation may impact the tax on high-income taxpayers giving added complexity to year-end tax planning strategies.

Tax Planning Strategies for Individuals. Year-end tax planning checklist. Dont wait - December 31st 2022 is coming fast.

Tax rules that took effect in 2018 as a result of the Tax Cuts and Jobs Act of 2017 brought about multiple changes for individual tax. Once the year is over the ability to reduce your taxes. In 2017 investment income for a child under age 18 at the end of the tax year or a full-time student under age 24 that is in excess of 2100 is taxed at the parents tax.

These are just a few year-end tax planning strategies that could help you reduce your tax liability. Take advantage of tax reform 3. Year-End Tax Planning Strategies.

Consider these year-end tax planning strategies to potentially reduce your taxes and help you achieve your long-term financial goals. 5 small business tax-planning strategies 1. Tax-gain harvesting is the strategic selling of investments at a profit when your tax rate is temporarily lower.

Since there are a lot of possible strategies we wrote this. Defer income or accelerate. 17 hours agoLets look at the following example of how increasing your 401 k contributions can lower your tax liability.

While every clients situation. Planning for taxes before year-end is essential for many reasons. 7 Tax Planning Strategies For Companies 1.

Keep up with changes in federal and state laws. Other Tax Planning Strategies. Gifting is likely to become a more important strategy if the federal estate tax exemption drops from todays 117 million per taxpayer or 234 million per.

Late November through year end is the time for year-end tax planning. Leverage coronavirus tax relief 4. This two-part webinar event includes presentations by subject-matter specialists on the latest tax.

Here are some of the most popular year-end moves to consider according to top financial advisors. As we approach the last few months of the year its a good time to consider tax planning and minimization strategies.

End Of Year Tax Planning Checklist

Tax Planning For The 2021 Year End Culpepper Cpa

2019 Year End Tax Planning Guide Blue Co Llc

2020 Year End Tax Planning Strategies For Individuals Marcum Llp Accountants And Advisors

Tax Planning Strategies For End Of Year 2019 Windes

How Traders Improve Tax Savings With Year End Strategies

Top 6 Year End Tax Planning Tips

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online

2021 Year End Tax Planning Strategies

Year End Tax Planning Tips Veterinary Practice Sva Cpa

3 Year End Tax Planning Strategies Arnold Mote Wealth Management

2019 Year End Tax Planning For Businesses 5 Key Strategies

Canon Capital Wealth Management Presents Best Year End Tax Strategies And Tips A Financial Literacy Seminar Canon Capital Management Group Llc

Year End Tax Planning Strategies For Contractors Cdp Inc Project Management Solutions

2020 Marcum Year End Tax Guide Reviews Impacts Of Covid And Planning Strategies For 2021 Marcum Llp Accountants And Advisors

Year End Tax Planning Strategies For Businesses Brooklyn Fi

Year End Tax Planning 2020 Important Financial Tasks Not To Be Overlooked

Tax Planning Strategies For Year End Tax Planning 2021 Corvee

5 Year End Tax Planning Strategies To Consider Before Ticker Tape